Income tax information

T2202 tuition and enrolment certificate

The T2202 contains the eligible tuition fees paid and attendance information needed for preparation of your income tax return and is available, for any given tax year, no later than the last day of February of the following year. If you pay an outstanding tuition amount for a prior tax year (beginning with 2019), Memorial will provide you with an amended T2202 form for the year the tuition payment was applied. You will then have to file an amendment to your tax return in order to claim the adjusted amount. For more information on filling amendments, please visit the Canada Revenue Agency webpage.

You can access your T2202 form in Memorial Self-Service:

- Go to Student Main Menu.

- Click Financial Information.

- select T2202 Information.

- select the tax year that you require.

If you have questions regarding your T2202 enrolment details or your eligible tuition fees, email registrar@mun.ca.

Adding/updating your SIN

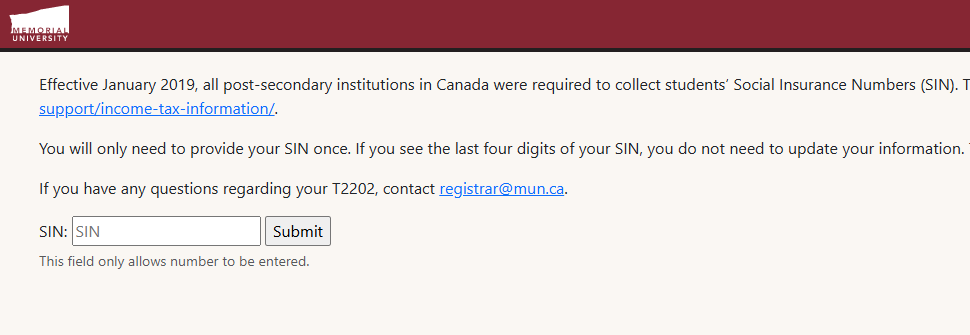

Effective January 2019, all post-secondary institutions in Canada were required to collect students’ Social Insurance Numbers (SIN). This information is required for the T2202 tuition and enrolment certificates. SINs need to be collected prior to the February T2202 processing. For more information about this required change in process, visit the CRA website.

You only need to provide your SIN once. If you received a notice informing you that you need to enter your SIN, follow the steps below:

- Visit my.mun.ca and click the Student Hub button within the Student Self-Service channel.

- Once on the Student Hub page, click Enter Social Insurance Number (SIN) which is located in the left-hand menu.

- On the Social Insurance Number screen:

- If you see an empty SIN box (as seen in the image below), please enter your Social Insurance Number.

- If you see the last four digits of your SIN, your Social Insurance Number is already on record. You do not need to enter it again.

Verify the last four digits of the SIN, if it matches yours, no further action is required. If it does not match, or your SIN has changed, contact registrar@mun.ca to erase your old SIN from your account. You can then complete the steps above to add your current SIN to your account.

If you have any questions about updating your SIN, reach out to registrar@mun.ca.