Pension Matters

Don’t discount your pension payments . . . someone regularly does that for you.

Determining whether a pension plan has a deficit (an all too frequent an occurrence) or a surplus (an occurrence to which a simile about the rarity of hen’s teeth readily applies) requires a ‘discount rate’. Every year or so, the University’s Pensions Advisory Committee is convened and tasked with recommending an appropriate pension plan discount rate. Currently, our plan’s discount rate is 5.8%. You might ask: now what does that even mean? Why would you discount our pension plan? Doesn’t it have enough trouble already? Well, unfortunately yes, but we need the discount rate to tell us when it’s in trouble and by how much. In fact, a pension plan’s discount rate serves many purposes: pension actuaries require it to assess the adequacy of plan’s funding; employee contributions are set using it; and, any extra employer payments to the pension fund are based on it. The discount rate is front and centre in the determination of those all-too-frequent deficits as well as the rare-as-hen’s-teeth surpluses. This writer is somewhat challenged to explain it but please permit me to try.

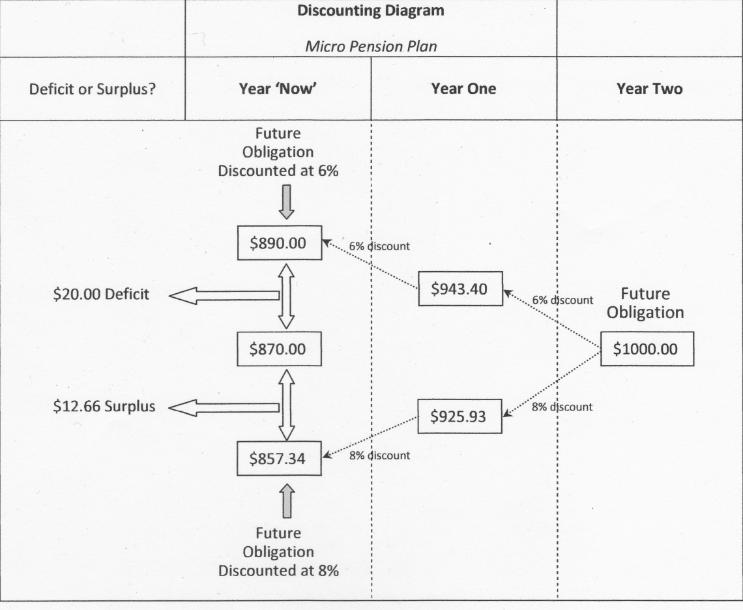

It will be helpful, and not all that strange, to think of the pensions paid to a plan’s beneficiaries and their survivors as a huge collection of payment obligations spread over many decades into the future. Pension administrators often want to know if there’s enough money in the current pension ‘kitty’ to make good on all those future obligations. To illustrate how the oddly named discount rate helps them with this, let’s examine a very simple ‘micro pension plan’ with just one future obligation consisting of a single $1000 pension payment that must be made to a pensioner two years from now. Let’s assume there’s $870 currently tucked away in the plan’s kitty. Is the $870 adequate to meet the plan’s obligation to its pensioner? Or, is the plan in deficit and in need of extra funding? Or, is there a surplus and maybe we can respond to an employee demand for extra benefits, perhaps (my personal favorite) full cost-of-living indexing?

Unsurprisingly we’ll need to invest the $870. The micro pension plan advisory committee is convened to determine what the financial resources of the plan could be expected to earn if placed in a collection of very safe investments. Let’s say the committee’s thoughtful deliberations result in a determination of 6%. In its report the committee notes that rates above 6% are possible but only arise for investments that are much too risky for the pension plan. Will the 6% be adequate? Will the plan show a deficit or a surplus? Let do some ‘discounting’. Keep the “Discounting Diagram” handy.

Note the $1000.00 pension payment in ‘Year Two’. Let’s work (right to left) through the upper path of connected boxes shown on the Discounting Diagram. Recalling your high school consumer math you eagerly discount the $1000.00 by 6% to give $943.40 for ‘Year One’ and then you discount the $943.40 by 6% to give $890.00 for ‘Year Now’. So, if we invest $890.00 at the committee’s recommended 6% we should safely obtain $1000.00 just in time to make the $1000.00 payment to our pensioner. But wait, we only have $870.00 in our pension kitty and not the $890 that must be invested. We need to add another $20.00 to bring it up to $890. Our micro pension plan has a deficit! And the amount of the deficit is $20.00.

Had our advisory committee concluded that an 8% return could be safely realized from investing the plan’s funds then (as seen in the lower path of the “Discounting Diagram”) a very different, much happier, outcome would have resulted: a $12.66 surplus and along with that could come the prospect of benefit improvements.

Some of you may wonder if there’s a discount rate that balances what’s currently in the pension kitty with the future obligation to our pensioner. There is! It’s 7.2% which, somewhat coincidently, is approximately the rate of return needed on the $1.6 billion currently held by the MUN Pension Plan (the kitty) to eliminate its $250-ish million deficit and meet all its financial obligations to our 2,400 or so pensioners and survivors every year into the foreseeable future.

There you have it: Pension Plan Discounting 101.