University Academic Calendar 2023-2024

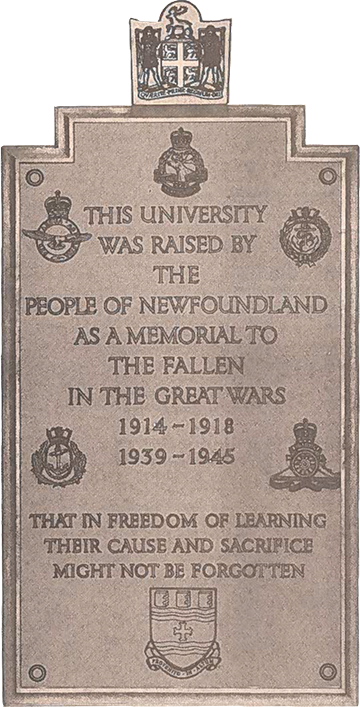

Perched on Canada’s North Atlantic coast, Memorial University of Newfoundland is a destination for discovery. A beacon for the 21st-century explorer, Newfoundland and Labrador’s university is a unique learning community founded as a living memorial to those who lost their lives in the First World War — "that in freedom of learning their cause and sacrifice might not be forgotten." Today more than 19,000 students from over 115 countries come together to discover. From the classics to advanced technology, the University offers certificate, diploma, undergraduate, graduate and postgraduate programs across five campuses, numerous locations and online. A global network of almost 100,000 accomplished alumni throughout the world strengthens Memorial University of Newfoundland’s capacity and reputation for leadership in world-class research, teaching and public engagement.

In Memoriam

Three hundred and ten former students of the Memorial University College offered themselves for active service in the Second Great War, 1939-1945. The University holds in special honour the past students who have been reported dead or missing and whose names are here given.

David Monroe Baird

Lawrence Banikhin

John Hamilton Barrett

Walter Robert Butt

Herbert Bond Clarke

Roy Clarke

William Bradley Collins

Thomas Joseph Delaney

John Kevin Evans

Victor Raymond French

Neil Willoughby Harnett

William Palmer Howse

David Simpson Kerr

Brendan David Lacey

Harold Lewis Learning

Lionel Edgar Legge

Wallace Clifford Luther

Edgar Raymond Martin

David Gordon Morris

Clarence Walter Parsons

Alexander Duncan Saint

Arthur James Samson

Bernard Thomas Scammell

Francis Smith

Eric Augustus Snow

Charles Henry Stewart

James Robin Stick

Philip Francis Templeman

Harold Baxter Wareham

James Walcot Winter

University Officers

Visitor

Hon. Joan Marie Aylward, Lieutenant-Governor of Newfoundland and Labrador

Chancellor

Chair of the Board of Regents

President and Vice-Chancellor Pro Tempore

Provost, Vice-President (Academic), and Pro Vice-Chancellor Pro Tempore and interim Associate Vice-President (Academic), Teaching and Learning

Vice-President Pro Tempore (Marine Institute)

Vice-President (Administration, Finance and Advancement)

Vice-President (Indigenous)

Acting Vice-President (Research)

Interim Vice-President (Grenfell Campus)

Searching Within the Calendar

The search bar at the top of each page of Memorial’s website can be used to search for specific words or phrases. To search within the full Calendar or within specific sections of the Calendar, here are some useful tips:

-

You can search the entire Calendar by adding the following web address “site:mun.ca/university-calendar” to the search bar after your search term. For example, to search for the word “ocean” anywhere in the Calendar, it would look like this: ocean site:mun.ca/university-calendar

-

Putting a multi-word search term in quotation marks will search for that specific phrase. For example, to search for “natural resources” anywhere in the Calendar: "natural resources" site:mun.ca/university-calendar

-

You can search specific sections of the Calendar by being more specific with the web address. For example, to search for the term “leadership” in the Grenfell Campus section: leadership site:mun.ca/university-calendar/grenfell-campus. Or search for the term “entrepreneurship" in the St. John’s Campus / Faculty of Business Administration section of the Calendar: entrepreneurship site:mun.ca/university-calendar/st-johns-campus/faculty-of-business-administration/

Tip: Instead of typing out the web address, navigate to the section of interest, copy the web address from the browser address bar and paste it after “site:” into the search bar.

Upcoming Diary for 2024-2025

Previous University Calendars

The following previous editions of the Memorial University of Newfoundland Calendar are provided for the convenience of students who are following the degree regulations in effect at the time they were admittted into a program. Students should consult Year of Degree and Departmental Regulations for more information.

Please consult the current University Calendar for information about current programs and current regulations.

- 2022-2023 University Calendar

- 2021-2022 University Calendar

- 2020-2021 University Calendar

- 2019-2020 University Calendar

- 2018-2019 University Calendar

- 2017-2018 University Calendar

- 2016-2017 University Calendar

- 2015-2016 University Calendar

- 2014-2015 University Calendar

- 2013-2014 University Calendar

- 2012-2013 University Calendar

- 2011-2012 University Calendar

- 2010-2011 University Calendar

- 2009-2010 University Calendar

- 2008-2009 University Calendar

- 2007-2008 University Calendar

- 2006-2007 University Calendar

Disclaimer

The contents of this calendar set forth the intentions of the University at the time of publication, with respect to the matters contained therein. THE UNIVERSITY EXPRESSLY RESERVES THE RIGHT TO DEVIATE FROM WHAT APPEARS IN THE CALENDAR WITHOUT NOTICE, including both the content and scheduling therein, in whole or in part, and including, without limiting the generality of the foregoing, the right to revise the content of, and to cancel, defer, reschedule or suspend, in whole or in part, the scheduling of particular periods of instruction, courses, or programs, and the academic program of the University, and to alter, accelerate or defer fees and charges, and to do any or all of the above for any reason whatsoever. THE UNIVERSITY HEREBY EXPRESSLY DISCLAIMS ANY OR ALL RESPONSIBILITY OR LIABILITY to any person, persons or group, for any loss, injury, damages or adverse effect, either direct or indirect, consequential or otherwise, arising out of any one or more of such deviations. The University hereby disclaims liability to any person who may suffer loss as a result of reliance upon any information contained in this calendar.

The rights and obligations of parties subject to the Calendar and the rules and regulations of Memorial University of Newfoundland shall be governed by the laws of the Province of Newfoundland and Labrador.

Each and every of the subsequent provisions contained in this Calendar, and the relationship, both legal and otherwise, between the University, and its students, is expressly subject to and governed by the above provisions.

The Office of the Registrar will assist students with any questions or problems which might arise concerning the interpretation of academic regulations. It is, however, the responsibility of students to see that their academic programs meet the University's regulations in all respects.

The information on this site has been extracted from the Official 2023-2024 University Calendar. While every reasonable effort has been made to duplicate the information contained in the official University Calendar, if there are differences, the official Memorial University of Newfoundland Calendar will be considered the final and accurate authority.

Copyright © 2024 Memorial University of Newfoundland.

Newfoundland and Labrador, Canada.

calendar.editor@mun.ca